Metro Atlanta’s Home Affordability Index

And if you’ve been thinking about buying – why I suggest you take action now!

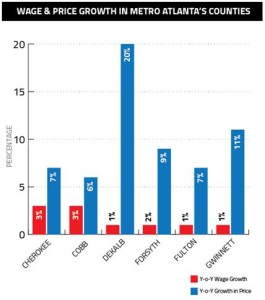

Nationwide, wage growth has lagged behind home prices, and the same is true here in Atlanta.

Back in April, RealtyTrac, reported that wage growth in the Atlanta area in 2013 and 2014 lagged far behind home prices, with home prices growing at more than 10 times the rate of wages; only San Francisco saw a greater disparity.

I recall counseling many prospective buyers and actual buyer clients in 2013 and 2014 that prices were increasing and that trend had no end in sight, especially for new construction homes – fortunately most acted on my advice and got a great home at a good value. In one unfortunate case because of possible company sale and job relocation, a Buyer Client I signed on in Dec 2013 had to hold off his search for nearly a year and could not act in 2014. Fast forward to Q1 and Q2 2015 and the type home he wanted (new construction) is simply not possible in his max price and preferred market areas. It’s too bad when someone completely misses a market window of opportunity – (not because they refused to acknowledge market realities or listen to sound advice from a market expert), but simply as in my clients case because it was impossible for him to act when the opportunity was there.

I don’t see us going back to 2014 prices anytime soon, if ever, especially for new construction, but there are two good things for the market right now relative to 2014: 1. interest rates have actually come down 13% over the last four quarters (currently about 3.7% ) but count on this to increase, and, 2. while prices are still trending up in fall 2015, they are not rising at nearly the velocity they were from 2013 to early 2015.

According to RealtyTrac’s new Affordability Report, from Q1 2014 to Q1 2015, home prices have risen beyond wages in all of Metro Atlanta’s six largest counties.

Here’s a graph of RealtyTrac’s findings:

Although home prices in Cherokee and Cobb County were relatively in line with wages, they still grew at twice the rate of wages– while in DeKalb, home prices vs wages grew at an astounding 20 percent, spurred on largely by new building and some great revitalization in older neighborhoods areas around the city of Decatur and westward toward Atlanta. DeKalb home prices in most markets south of Decatur had nowhere to go but up because for many years home prices have been severely depressed in part because of excess foreclosure inventory and other factors such as high crime rates and poor schools.

Home Affordability in 2015 Improves Even as Home Price Growth Outpaces Wage Growth…But, Forces of Change Loom on the Near Horizon

According to a study conducted by RealtyTrac and Clear Capitol, which was released on October 1, 2015, average home price appreciation outpaced average wage growth between the first quarter of 2014 and the first quarter of 2015 in 397 out of 582 (68 percent) U.S. counties analyzed for the report. In its report, RealtyTrac emphasized that since bottoming out in the first quarter of 2012, the average U.S. home price has risen 24 percent, while the average weekly wage nationwide has risen 7 percent.

As the video explains home affordability improved to a two year low in Q1 2015 even with rising home prices – and a big driver has been the current low interest rates. Between early 2014 and early 2015 the average interest rate on a 30-year fixed rate mortgage dropped 57 basis points (13 percent), from 4.34 percent in the first quarter of 2014 to 3.77 percent. What should be of concern now, and motivate any would-be buyers into action sooner rather than later – all of the Feds recent chatter about raising the interest rates. We just escaped a planned rate increase last month, but with the economy continuing to improve a rate increase is only a matter of time – many experts believe we will see an increase by December. Any uptick in interest rates will have a corresponding negative impact on metro Atlanta’s home affordability index, impacting both the monthly payment and size of loan a buyer can qualify for.

Want more info about the current market, or to discuss some of the historic benefits of buying a home in the fall – Call me now 678-585-9691 – Robert Whitfield

https://youtu.be/uYFGnYx4lhM&rel=0

posted in Atlanta Housing Market, Home Buyers, New Posts | Comments Off on Metro Atlanta’s Home Affordability Index